Contents

A HELOC, or home equity line of credit, may be a potential funding source for many Americans who face the COVID-19 crisis.

These loans are usually 5 to 10 years long and require borrowers to repay only a fraction of the loan during that time. Although balloon … This calculator lets you create a repayment plan that fits …

Your balance or ‘Balloon Payment Amount’ will be due at this time. Also choose whether ‘Length of Balloon Period’ is years or months. The monthly payment and interest are calculated as if the mortgage or loan were being paid over this length.

Your balance or ‘Balloon Payment Amount’ will be due at this time. Also choose whether ‘Length of Balloon Period’ is years or months. The monthly payment and interest are calculated as if the mortgage or loan were being paid over this length.

Mortgage Note Template Illinois PHH Mortgage offers loans to help you buy a home as well as loans to help you refinance. Let’s take a closer look at what PHH has to offer in this review. payoff mortgage promissory Note “david Young” Most new investors in active real estate start with a traditional method like rehabbing or buying and

Difference Between Promissory Note And Mortgage Nov 28, 2015 · Yes, there is a difference between a mortgage and a promissory note. The mortgage, also known as a deed of trust, is the document that provides the security for the loan. The promissory note is the actual binding document with the promise to pay back the loan. Each document should contain some

Purchase Of Land For Cash $ 295000 Purchase Of Land By Issuing Long-term Mortgage Note $ Difference Between Promissory Note And Mortgage Nov 28, 2015 · Yes, there is a difference between a mortgage and a promissory note. The mortgage, also known as a deed of trust, is the document that provides the security for the loan. The promissory note is the actual binding document with the promise to pay back the

Here are her tips on how to deal with a financial emergency, and suggestions on how to approach issues such as cash flow, …

Donate A Mortgage Note To Charity I Am The Creditor I’ve been writing about money, and this is the toughest time I have known for finding the right tone, says . But there are … Payoff Mortgage Promissory Note “david Young” Most new investors in active real estate start with a traditional method like rehabbing or buying and holding single-family rentals. They might invest in

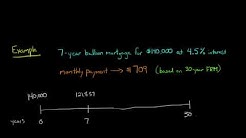

A balloon mortgage is specific type of short-term mortgage. Borrowers make regular payments for a specified period. They then pay off the remaining principal within a short time. Many balloon mortgages will be interest-only for 10 years. A final "balloon" payment to pay off the full balance comes as one large installment when the term is up.

calculate balloon mortgage payments. A balloon mortgage can be an excellent option for many homebuyers. A balloon mortgage is usually rather short, with a term of 5 years to 7 years, but the …

These days, it’s not very common for the topic of reverse mortgages to appear as the center of a news story in your local newspaper, and even newspapers themselves are not as prominent as they used to …

Burial insurance is a type of life insurance designed specifically to pay for a funeral and small final expenses. Find out if …

Mortgage Note Percentages Difference Between Promissory Note And Mortgage Nov 28, 2015 · Yes, there is a difference between a mortgage and a promissory note. The mortgage, also known as a deed of trust, is the document that provides the security for the loan. The promissory note is the actual binding document with the promise to pay back the

Default Failure to make a mortgage payment on a timely basis, or comply with other requirements of a mortgage … They are responsible for obtaining final signatures and recording the transaction.

Default Failure to make a mortgage payment on a timely basis, or comply with other requirements of a mortgage … They are responsible for obtaining final signatures and recording the transaction. Credit Purchase Purchasing land with a loan affects the assets and liabilities sections of the balance sheet. The land is recorded at its full cost as a long-term asset. The cash down payment …

Credit Purchase Purchasing land with a loan affects the assets and liabilities sections of the balance sheet. The land is recorded at its full cost as a long-term asset. The cash down payment … The federal

The federal  Are these two documents all I need to prove that I paid off my mortgage or do I want them to give me anything else? Do I need …

Are these two documents all I need to prove that I paid off my mortgage or do I want them to give me anything else? Do I need … In late February, before a coming pandemic had begun to sweep the nation, back when the Democratic primary field was crowded …

In late February, before a coming pandemic had begun to sweep the nation, back when the Democratic primary field was crowded … As mortgage borrowers start to request forbearance assistance amid COVID-19, long holds and unclear terms seem to be the …

As mortgage borrowers start to request forbearance assistance amid COVID-19, long holds and unclear terms seem to be the …![Investing in Mortgage Notes with Jorge Newbery, CEO of AHP [Podcast]](https://i.ytimg.com/vi/T8YrxVLGUO8/hqdefault.jpg?sqp=-oaymwEjCPYBEIoBSFryq4qpAxUIARUAAAAAGAElAADIQj0AgKJDeAE=&rs=AOn4CLCi8qZhD3GDXUZHonV01ALRKInHqw) The nation’s most innovative affordable housing program has survived 25 years … see their program as an emblem of civic pride. They note that while new subdivisions in most suburban areas …

The nation’s most innovative affordable housing program has survived 25 years … see their program as an emblem of civic pride. They note that while new subdivisions in most suburban areas …